Waiting for mortgage rates to come down before you buy?

Why this may not be the best long-term strategy

We hear from many customers that they would love to buy or build a new home, but with mortgage rates at 20-year highs, it does not seem to make sense. And why should it? If you bought or refinanced your home back in 2020 and have a 30-year fixed rate locked at 3%, it will cost you a lot more money in the long run by buying a new home today. Well, that may not be the case.

Let’s take a look at some historical facts1:

- From 2018 through 2022, inflation has averaged 3.81%

- From 2018 through 2022, the median home price in the Lancaster, PA MSA has gone up by 8.74% on average

- Looking back over 20 years, the average 30-year fixed rate is 4.8% and, over that same period, has averaged below 5% for 12 of those years.

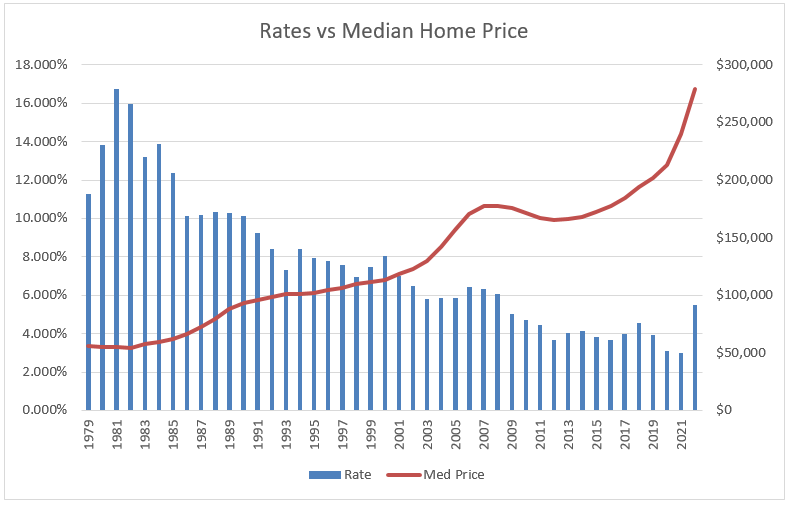

Moreover, if you do a 40-year look back on how interest rates coincide with median home prices, you will see a direct correlation.

The fact is, when rates are lower, demand surges and ultimately drives up home prices.

Here’s the great news…. While you likely have a long-term commitment to your new dream home, the financing option you choose today may not be permanent.

So, let us assume that inflation and median home prices continue to rise on average as they have over the past 5 years. That means a home selling for $400,000 today would be at a price tag of $514,314 in 3 years. So even if the 30-year fixed rate is down to 5% at that time, assuming you put 20% down and borrowed $411,450, your Principal and Interest (P&I) payment would be $2208.76 per month.

Now, let us move back to the present and assume you are putting 20% down on that same home today and borrowing $320,000 at a rate of 7.5%. That would put you at a Principal and Interest payment of $2237.49. Granted, that may be a bit higher than your current payment, but when comparing it to what it may be in 3 years from now anyway, you are looking at less than it costs to take a family of 4 to McDonald’s® once per month.

Now, here is the real kicker. Under the look forward scenario where rates are at 5% in 3 years from now (fictitiously speaking, of course), had you bought today, your principal balance would be paid down to $310,446, assuming you did not make any additional payments. Well, guess what… you can now refinance that balance, and assuming that same 5% interest rate, your new P&I payment would be $1666.54.

To summarize this math under the exact same interest rate scenario:

Future P&I by waiting: $2208.76

Future P&I by buying now: $1666.54

Monthly difference: $542.22 (that is over $6500 annually)

Granted, you have to be the one who is comfortable that the current mortgage payment is within your budget today, and nobody can guarantee that rates will be at 5% within 3 years (actually, nobody can guarantee that rates will ever go down). But if they don’t and you’re ultimately in a position where you need to buy a new home, then if rates are exactly the same (using the 7.5% scenario), that future mortgage of $411,450 is now coming at a monthly P&I payment of $2876.92 per month; nearly $640 more per month than had you bought today.

Under any interest rate scenario, so long as inflation and housing prices continue to follow historical trends, it will always cost you more in the long run by waiting.

The moral of the story: if you have found your dream home but are intimidated by the current rates, don’t be. Waiting may cost you thousands of dollars in the long run.

1https://www.macrotrends.net

This article contains forward-looking assumptions, which include information concerning future financial, industry, or market conditions and general economic conditions. Forward-looking statements are not guarantees; they involve risks, uncertainties, and assumptions. Although we make such statements based on assumptions we believe to be reasonable, actual results may differ materially from those expressed in the forward-looking statements. We caution consumers not to rely unduly on any forward-looking assumptions within this article and urge you to consider all financial risks carefully. We expressly disclaim any obligation to update any forward-looking statement in the event it later turns out to be inaccurate, whether as a result of new information, future events, or otherwise.